Featured

Anti Money Laundering Life Cycle

The concept of cash laundering is essential to be understood for those working in the monetary sector. It's a course of by which soiled cash is converted into clear cash. The sources of the money in precise are legal and the money is invested in a approach that makes it appear to be clean cash and conceal the identity of the prison part of the cash earned.

Whereas executing the financial transactions and establishing relationship with the brand new prospects or sustaining current clients the duty of adopting ample measures lie on each one who is a part of the organization. The identification of such element to start with is easy to take care of instead realizing and encountering such situations afterward within the transaction stage. The central bank in any country offers full guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously present enough security to the banks to discourage such situations.

However it is important to remember that money laundering is a single process. A Comparative Analysis Of The Anti Money Laundering Policies In The United States Of America The United Kingdom Australia And Canada Nicholas Ryder order another paper later this month.

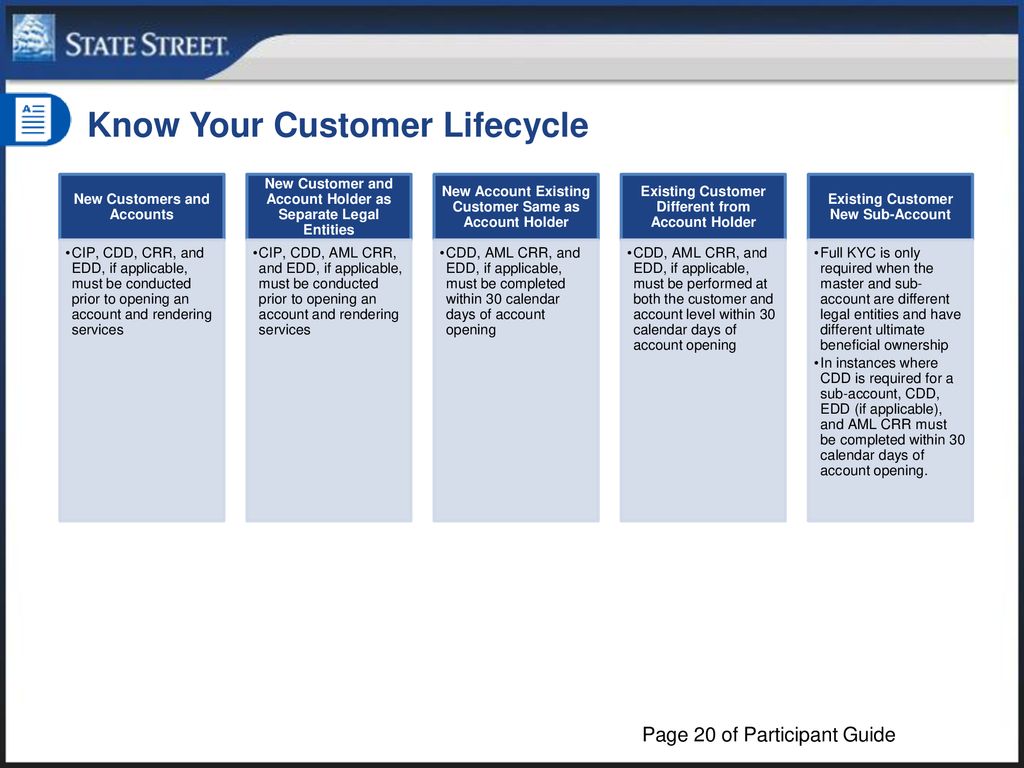

Instructor Notes Know Your Customer Ppt Download

Moving the funds from direct association with.

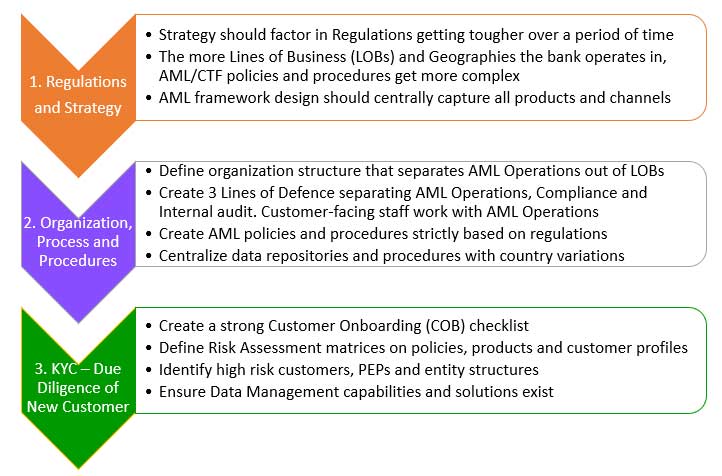

Anti money laundering life cycle. Anti-Money Laundering AML Lifecycle The Customer Identification Program is the first of many phases that make up the anti-money launderingknow your customer lifecycle. The money-laundering cycle can be broken down into three distinct stages. The money laundering cycle can be broken down into three distinct stages.

Anti-money laundering compliance tools for insurers insurtechs brokers and re-insurers giving you a granular view of your customers risk thoughout the client lifecycle. Money launderers and terrorists are identifying weak links in your AMLKYC Anti-Money LaunderingKnow Your Customer processes to help them hide the true source of funds and their connection to it. Money laundering has one purpose.

During the onboarding phase CIP is the first stage through which banks and other financial institutions identify and verify the true identity of new clients looking to open new accounts. Money laundering is the process by which the illegal origin of wealth is disguised to avoid the suspicion of law enforcement authorities. By blocking access to those that want to bypass your safeguards in the first place your prevention systems will be more robust and secure.

This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms. The 3 Stages of Money Laundering.

SAS Anti-Money Laundering is a proven platform that improves detection accuracy and can lower total cost of ownership. Firms must comply with the Bank Secrecy Act and its implementing regulations AML rules. It provides transaction monitoring customer due diligence real-time sanctions and watchlist screening and regulatory reporting enhanced by advanced analytics capabilities like machine learning and robotic process automation.

There are a number of ways or methods used for money laundering however the money laundering cycle can be broken down into three basic stages which are as follows Placement. The 5th AMLD is to come into effect in January 2020. Three Basic Stages or Methods of Money Laundering Cycle Money Laundering Cycle Principle Layering Integration.

Built-in internal operations user-processing policies accounts monitoring and detection and reporting of money laundering incidents. Anti Money Laundering AML seeks to deter criminals by making it harder for them to hide ill-gotten money. Going to Money Laundering An Endless Cycle.

What is an AML compliance program. The stages of money laundering include the. The 5th directive will require you to examine the background and purpose of a wider range of transactions.

However it is important to remember that money-laundering is a single process. Placement The physical disposal of cash or other assets derived from criminal activity. FINRA reviews a firms compliance with AML rules under FINRA Rule.

In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the legitimate financial. Here are some of the most common ways this is achieved. During the placement phase illicit proceeds are introduced by the money launderer into the financial system.

Money laundering involves the use of processes to disguise an original source of funds or assets that are generated through criminal activities such as drug trafficking fraud smuggling corruption or extortion. The Anti-Money Laundering Compliance Alert Life Cycle Management Process and System invention is a dynamically active tool for aiding analysts in reaching decisions to cancel or release financial transactions so that money laundering and fraud may be easily and efficiently prevented. Global markets consider money laundering a significant white collar crime.

The Placement Stage Filtering. The money laundering process is divided into 3 segments. Citi is committed to the fight against money laundering and leading the way in Responsible Finance.

It proposes extra EDD measures for business relationships and transactions with high-risk 3rd countries. Criminals use money laundering to conceal their crimes and the money derived from them. Three Stages of Money Laundering Cycle.

The stages of money-laundering include. To turn the proceeds of crime into cash or property that looks legitimate and can be used without suspicion. There are usually two or three phases to the laundering.

Money laundering undermines confidence in the international financial system. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation.

4 Differences Between Money Laundering And Terrorist Financing

Guidance On Money Laundering Terror Financing Risk Assessment By Nbfcs

What Is Anti Money Laundering Aml Anti Money Laundering

Aml Kyc Onboarding Lifecycle Process Flow Guide Advisoryhq

Anti Money Laundering Ppt Powerpoint Presentation Infographics Skills Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Aml Kyc Onboarding Lifecycle Process Flow Guide Advisoryhq

Finamlor Provides A Comprehensive Anti Money Laundering Software Solution Finacus

Anti Money Laundering Transaction Monitoring System Implementation Considerations Acams Today

Anti Money Laundering In The Cloud Are We There Yet Aite Group

The world of laws can seem like a bowl of alphabet soup at times. US money laundering regulations aren't any exception. We've compiled a list of the highest ten money laundering acronyms and their definitions. TMP Risk is consulting agency centered on defending financial services by reducing danger, fraud and losses. We've massive financial institution experience in operational and regulatory threat. We've a powerful background in program administration, regulatory and operational threat in addition to Lean Six Sigma and Business Course of Outsourcing.

Thus money laundering brings many hostile consequences to the group as a result of risks it presents. It will increase the chance of major risks and the opportunity cost of the bank and in the end causes the bank to face losses.

Popular Posts

Public Golf Courses Sarasota Florida Area

- Get link

- Other Apps

Comments

Post a Comment